So today I wanted to figure out which payment method actually sucks less when you’re buying stuff online – EMI or this ABD thing that kept popping up. My wallet screamed at me last week after another gadget splurge, so I grabbed a spreadsheet and my card like it was detective work time.

The Starting Confusion

I remember staring at checkout options for this pricey smartwatch. ABD said “buy now, pay later in parts” – looked like EMI. EMI outright mentioned interest rates. Both promised easy payments. My head hurt. What even is the difference? Felt like picking between mystery boxes.

My Deep Dive Chaos

Alright, I grabbed two things I didn’t really need but pretended it was for the test:

- A fancy coffee maker (paid with EMI)

- A set of wireless earbuds (went with ABD)

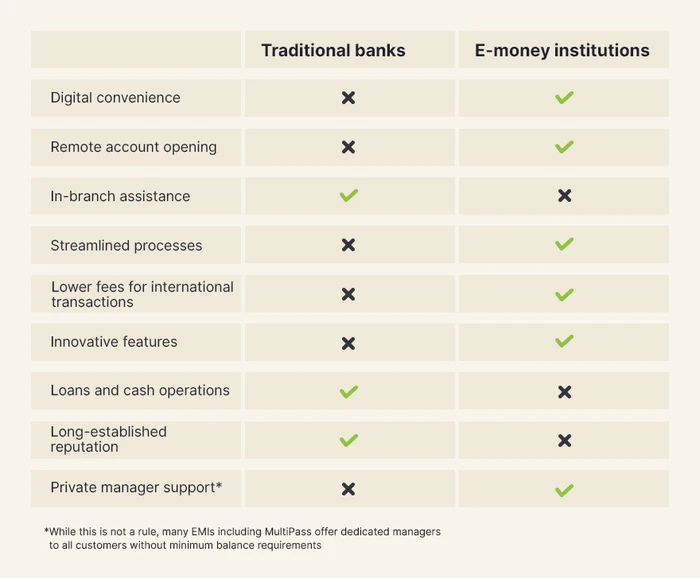

First surprise hit immediately: ABD wasn’t a loan. No bank involved, just the merchant splitting the total amount into chunks themselves. My coffee maker EMI? Yeah, that actually needed bank approval behind the scenes. Who knew.

Then came the cost comparison. Big shocker there. My spreadsheet filled up fast:

- Interest Costs: EMI slapped on that extra interest fee like an annoying sticker – clear as day on the bank statement. ABD? Showed me a flat total amount split into parts. But here’s the scammy bit – when I calculated the difference between the “pay now” price and my ABD total? Oh man, that hidden markup was worse than the EMI interest sometimes.

- The Fine Print Trap: EMI usually locks you in for the whole term. Want to pay off the coffee maker early? Tough luck, still paying most of that interest. ABD felt looser – missed one earbud payment? Got hit with a late fee, but no scary interest snowball. Felt less like jail, more like a time-out corner.

- Who Actually Owns It?: This one blew my mind. With EMI, the bank technically owns that coffee maker until you cough up the last cent. Mess up payments? They could potentially come knocking. ABD? Paid that first chunk? The earbuds were mine, period. Felt safer, somehow.

The Messy Verdict

Here’s the raw truth after my personal finance wrestling match:

- EMI wins if you see a sweet zero percent offer from the bank – actual free money split into pieces. Snatch that up! Otherwise, prepare for the interest sting.

- ABD feels smoother and less invasive (no credit check drama!), but you gotta be a detective. Compare that total ABD cost against the “pay now” price like your life depends on it. Sneaky markups hide there. If the markup is lower than the EMI interest would be? Maybe worth it for the simplicity.

- Plan on paying early? EMI usually punishes you anyway. ABD might let you escape earlier, saving some of that sneaky markup cost – check their rules!

- Late payments suck everywhere, but ABD fees felt predictable – just a slap on the wrist. Missed EMI payments? Potential credit score headache brewing.

Bottom line? There’s no magical winner. My coffee maker needed EMI ’cause the bank offered zero interest – felt like a win. The earbuds? Found an ABD deal where the total extra cost was actually lower than any EMI bank offer I got – and simpler, since I got the buds instantly. For big splurges? I’m putting them head-to-head in my spreadsheet every single time now. Spreadsheets: the only way to see through the payment nonsense.